Lab-made meat, fish and dairy are transforming farm to table.

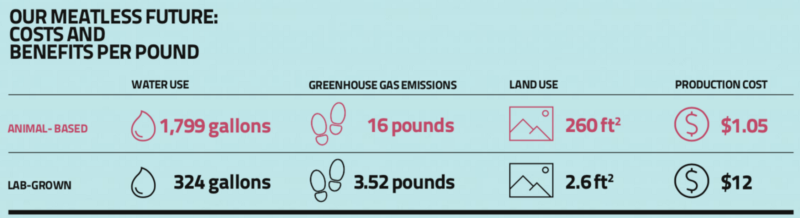

If ever a sector was ripe for disruption it is food. Livestock is a major contributor to greenhouse gas emissions and uses up a significant portion of land and of the world’s water and food supply.

When you factor in the anticipated explosion in global population and demand for protein, the situation is simply not sustainable.

Startups using technology to engineer meat in labs or manufacture it from plant-based products are threatening the future of the $90 billion meat industry, from farm to table. The meat value chain could be simplified dramatically, as so called “clean meat” laboratories that manufacture meat from animal stem cells take the place of farms, feed lots and slaughterhouses, according to a recent report from the research firm CBInsights.

The fishing industry is also facing massive disruption, as is the dairy market. Startups are experimenting with a variety of new ways to “make” meat. Impossible Foods, a major player in the space, leverages molecular engineering to create “bleeding” plant-based burgers that the company claims are nearly indistinguishable from meat.

The company’s discovery of heme, an iron-rich molecule in animal proteins, has enabled it to replicate the “meaty” flavor in their plant-based products. The company recently announced that it’s expanding distribution channels to university cafeterias, museum cafes, and other retail outlets in the United States. Beyond Meat is another major company making plant-based burgers and other imitation meat products such as chicken strips and beef crumbles. The company also has been experimenting with a plant-based pork product.

Test-tube Meatballs

Lab-grown meat, also known as “cultured or clean meat,” could be a bridge between real meat and plant- based products. San Francisco-based

Memphis Meats makes meat from self-reproducing cells, thereby fabricating meat that is an “animal-based” product but avoiding the need to breed, raise and slaughter huge numbers of animals.The company debuted its first synthetic meatball in 2016 and followed up with the wor ld’s first cell-cultured chicken and duck earlier this year. And three Israel-based startups — SuperMeat, Future Meat Technologies and Meat the Future — have announced a deal to import lab-grown meat to China as part of a broader government plan to decrease the country’s meat consumption by 50%.

While still in early stages of research and development, fish-free products are further expanding the possibilities of an animal-free future, says the CBInsights report.

New Forms of Protein

Finless Foods uses cellular agriculture to develop faux fish meat, while New Wave Foods produces pea protein and algae-based imitation shrimp, the French startup ODONOTELL produces algae-based salmon and Ocean Hugger Foods has developed ahimi, a tomato-based raw tuna substitute, an eggplant-based eel and carrot-based salmon substitutes.

As with animal-free meat, analysts say fishless foods could radically simplify and clean up the seafood production value chain.

Startups are also building businesses around making snacks or food staples such as flour from insects. Cricket-raising results in 100 times lower greenhouse gas emissions than beef cow production, and crickets also have higher proportions of protein than beef or chicken, according to CBInsights. And because crickets require proportionally less feed than livestock animals, production is more efficient.

Animal-free dairy products are also on the horizon. Perfect Day, a U.S. startup, makes milk without the need for a single cow. The co-founders obtained a strain of yeast, which they call Buttercup, from an open-source U.S. Department of Agriculture database. They then obtained a cow’s DNA sequence, had it printed using a 3D-printer and inserted it into a specific location of the yeast, converting plant sugars into milk proteins (casein and whey) using fermentation. The milk proteins were then combined with plant-based fats and nutrients to get milk that’s lactose free. “We are creating animal-free dairy proteins that provide the same exceptional nutritional benefits of animal-derived dairy protein while leaving a kinder, greener footprint,” says Perfect Day co-founder Ryan Panda.The bulk of the dairy industry’s output — around 80% — is not consumed as milk but is used by the food and beverage industry to produce a whole range of products like yogurts, cheeses and salad dressings. Just, formerly known as Hampton Creek Farms, is making eggless mayonnaise while Notco is making plant-based greek yogurt, cheese and milk in addition to mayo.

Active investors in the food tech space include IndieBio, which has placed bets on Memphis Meats, New Wave Food, and Finless Foods, as well as startups focusing on dairy like Perfect Day and Notco. Large corporations involved in the meat industry are investing in meat innovation as a form of outsourced R&D, notes CBInsights.

Investing in Alternatives

The food-trading giant Cargill participated in Memphis Meats’ Series A round, while Nestle, which owns a number of frozen food brands that incorporate meat, acquired the vegan prepared-foods producer Sweet Earth in September. Additionally, the rise of funds with a strong emphasis on alternative meat production and innovation, such as Tyson New Ventures, suggests that meat producers foresee the possibility of a meatless future. Tyson New Ventures made its first investment in Beyond Meat in October 2016, an indication that it may be looking to pivot from a meat producer to a more broadly protein-friendly brand, according to the report. Nevertheless, today lab-grown meat is still significantly more expensive than meat from traditional sources and some question how easily it will scale. “Though many startups in the space claim that their products will revolutionize meat consumption, the question remains whether clean meat and substitute foods will provide a scalable method to feed the future — or whether it’s simply a new wave of molecular gastronomy.”