The finance sector may not agree on the virtues of cryptocurrencies, but they are embracing blockchain, the technology underpinning them.

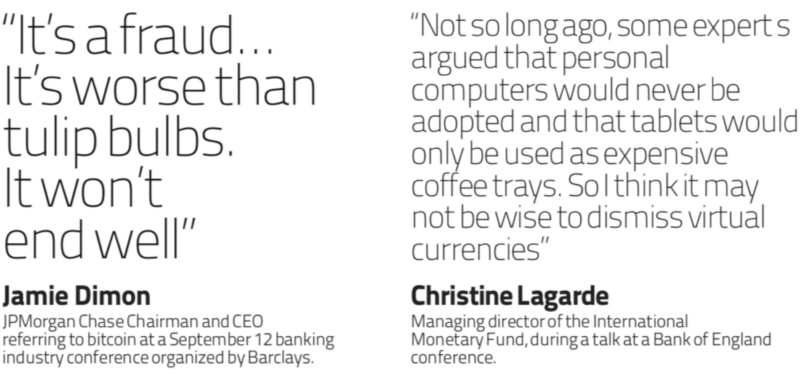

The finance sector is divided on the virtues of cryptocurrencies such as bitcoin.J amie Dimon made headlines when he recently said he would fire any trader who was “stupid” enough to trade in them.But there is one thing that almost everyone in the banking industry agrees should be embraced: blockchain, the technology underpinning cryptocurrencies.

Banks are scrambling to hire blockchain experts and are joining technology-oriented consortia such as R3, the Enterprise Ethereum Alliance or Hyperledger.They are first focusing on low-hanging fruit: areas where there is a lot of inefficiency such as global payments, trade finance, automated compliance and post-trade processing. Potential savings from efficiency gains are between $80 billion and $110 billion, says the blockchain expert Oliver T. Bussmann, a former CIO at UBS. SWIFT, in collaboration with leading global transaction banks, is developing a proof-of-concept application that will test whether distributed ledger technology can be used by banks to improve the reconciliation of their nostro accounts in real time, optimizing their global liquidity.

But it would be a mistake for banks to regard this as just an efficiency play, Bussmann says. Blockchain gives them the opportunity to become the backbone of large-scale, open, decentralized business platforms, he says.

A first step toward that end is for banks to organize themselves into blockchain-based business networks and consortia, such as one involving the U.S. startup Ripple, an enterprise blockchain solutions provider, which has built a blockchain-based direct settlement network with more than 75 banks and payment providers. The company has partnered with about 90 additional banks across the globe, including Standard Chartered Bank, Banco Santander, National Australia Bank and BBVA.

Several banks recently signed up to start using its technology for cross-border payments, including France’s Crédit Agricole, Brazil’s Bexs Banco and Uruguay’s dLocal.

Banks need to be creative

SEB, the Swedish bank used Ripple’s system to transfer $180 million between Sweden and the U.S. in recent months to help manage the cash balances of one of the bank’s large corporate customers. Ripple’s cross-border payments system is based on using its XRP cryptocurrency, which customers buy and sell almost instantaneously to move money between countries and currencies over the company’s system. It allows cross-border payments to be completed within 10 to 15 seconds, compared with about three days for interbank transactions using the Swift network. But along with opportunities for improving the way existing business is done, blockchain poses some challenges. The new, decentralized business platforms unleashed by blockchain are spawning new, decentralized business models that threaten some of banks’ core businesses. “For banks the issue is that access to capital is being disintermediated pretty aggressively” by initial coin offerings (ICOs), an unregulated way of crowdsourcing funds, notes Lex Sokolin, a partner and global director of fintech strategy at Autonomous Research. Some $2.3 billion in funding has been raised that way in a very short period of time and banks haven’t been involved at all.

“It is the wild, wild west but crowdfunding (through ICOs) actually works. You are adding value to these projects without the existing financial system,” Sokolin says.

Banks need to think creatively about how they might carve out a role in this new world, he says. They could, for example, become the on-ramp and off-ramp between fiat and crypto-currency and offer data and analytics around different new products. To remain relevant banks will need to hire skunk-work developers who can visit Internet forums and use tools like Slack and Telegram, where a lot of the conversation is taking place — and figure out how to get the data and how to analyze it, Solokin says.“When the number one incumbent is talking about this negatively it is actually a bullish signal,” Solokin says. “If Jamie is being publicly negative then it means it is actually reaching him. This shows the power of the moment. This thing is really going mainstream.”