Startups could be the industry’s lifeline

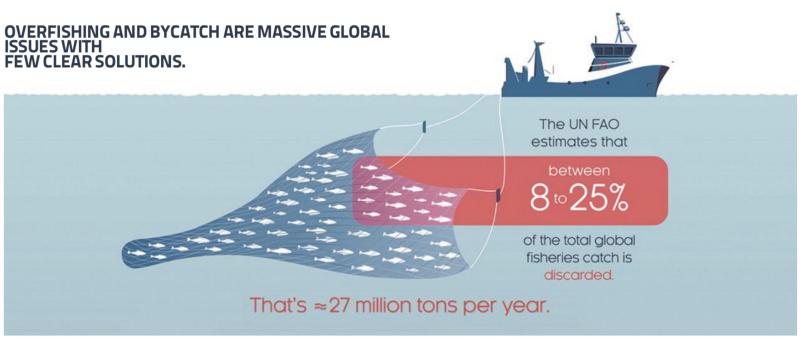

SafetyNet Technologies, a UK startup, uses light-based visual stimuli to alter the species and size selectivity of different fish capture processes. The goal? To reduce the 27 million tons of so-called bycatch fish that the global fisheries industry discards each year. Overfishing and bycatch fishing are not only a threat to a sustainable food source, wasting 8% to 25% of the global catch comes at a cost of $1 billion a year. The UK startup is one of seven startups accepted so far into the 2018 program of the Bayer Foundations, an arm of Bayer, the German global life sciences company that focuses on the healthcare and agriculture sectors, and that has been funding health, nutrition and education since 1896.

Today the foundation sets aside a total of $15 million a year to fund startups and products aimed at social good. While the program has a strong focus on health, the scope is being widened in 2018 to include startups targeting the agriculture, food and beverage industries. It plans to fund up to another 20 startups in food and agriculture this year and is actively seeking them out at international conferences.

“We consume too much food, we produce too little food, and our farming screws up the environment,” says Marc Buckley, a startup jury member and an open innovation advisor to Bayer Foundations. “Innovators are needed for a reframing of the global food system.”

Analyzing The Threat

Bayer is not the only big corporate fishing for food and beverage start-ups. For some companies in the sector, investments in disruptive startups could literally be a lifeline. Take the case of food companies such as Tyson Foods, Pilgrim’s and Sanderson Farms. More than 80% of these companies’ revenues come from selling meat. But as startups introduce technologies to create beef, chicken, duck, shrimp, fish and dairy products from plants or animal cells, food giants are suddenly grappling with a future in which protein isn’t dominated by traditional animal sources, notes the research firm CB Insights. The $90 billion global meat industry has evolved into a complex global business that involves farms and feedlots as well as meat middlemen, like processing and storage centers, in addition to transportation and logistics and slaughterhouses. Together the seven largest meat companies combine for over $71 billion in market capitalization, with the largest, Tyson, boasting a $26 billion valuation, according to CB Insights data.

But now meatless food products from beef-free burgers are threatening the future of the meat giants. In addition to offering new products, such as alternative snacks like Beyond The Shoreline’s kelp jerky or Exo’s energy bars (which are made from cricket flour), these startups have the potential to upend all parts of the meat production process.

In the future, companies like Memphis Meats could cut production, slaughter, and processing out of the meat-production value chain, predicts CB Insights. Going forward, the meat value chain could be simplified dramatically as “clean meat” labor factories take the place of farms, feed lots and slaughterhouses. Such a shift would have a major impact not just on a variety of businesses but also on land, water and food use worldwide. Tom Hayes, the CEO of Tyson Foods, has publicly acknowledged the traction of products like those made by Impossible Foods, a World Economic Forum Technology Pioneer, saying “plant-based protein is growing almost, at this point, a little faster than animal-based, so I think the migration may continue in that direction.”

Investing In The Future

Impossible Foods, which has raised over $250 million in venture capital, uses heme, an iron-rich molecule in animal proteins to replicate a “meaty” flavor in their plant-based products.

After closing a $75 million late-stage round in August, to aid in ramping up its production and distribution channel, the company announced that it’s expanding distribution to include university cafeterias, museum cafes, and a U.S. burger chain.

In the future, Impossible Foods could apply its technology to new animal-free substitutes, such as pork, seafood and lamb — even further disrupting traditional meat corporates’ frozen or prepared food products, predicts CB Insights. Tyson has set up a venture fund called Tyson New Ventures and is looking to invest in “great-tasting alternative proteins.” Its first investment, made in 2016, was in a startup called Beyond Meat, which makes plant-based burgers and other imitation meat products such as chicken strips and beef crumbles. Beyond Meat has also has been experimenting with a plant-based pork product. The food trading giant Cargill has invested in Memphis Meats, which uses stem cells from real animals to grow meat in a lab. Its investors include Bill Gates of Microsoft, Richard Branson of Virgin Group and the former GE Chairman and CEO Jack Welsh. Nestle, which owns several frozen food brands, has acquired the vegan prepared foods startup Sweet Earth.

By providing new food sources, meal replacements and dairy substitutes could further chip away at traditional meat market share, says CB Insights. Companies like the pea-protein milk producer Ripple Foods, the non-dairy cheese provider Kite Hill and the AI-powered eggless mayo producer NotCo already are selling their products in grocery stores. Another company, Perfect Day, is applying gene sequencing and 3D printing to create milk without the cow. The company has raised over $2 million disclosed funding from Temasek Holdings and other investors. Although it is still early days, startups look well poised to help deliver safe, affordable and sustainable protein to people as population growth moves towards nine billion. Others, such as the those Bayer is investing in, could also help feed the world and make food production more stable through novel farming and fishing methods.

By betting on startups that are disrupting the industry from farm to table, existing players are hoping to ensure that despite major industry upheaval they will continue to play an important role in the future of food. “Here’s the issue: If we’re going to feed nine and a half billion people around the world by 2050, we have to be part of the solution. Big food has to get in the ballgame,” Hayes, Tyson’s CEO, said during a November interview on CNBC in the U.S. that focused on sustainability. “Our strategic intent is to be the world’s best, most sustainable protein supplier, bar none.”