Australian energy producer Woodside Petroleum operates 6% of the world’s liquefied natural gas supply. As demand for greener sources of energy increases, Woodside is diversifying the products it offers customers to support their decarbonization goals. It is planning to invest $5 billion by 2030 in emerging new energy products and lower carbon services, such as hydrogen, ammonia, offsets, carbon capture and storage, and carbon utilization. It is already involved in a range of collaborative dialogues and studies with potential customers, such as Japanese power generators, and receiving ports like Singapore and Rotterdam, about green hydrogen.

Australia’s leading natural gas producer’s planned transition towards hydrogen and ammonia production is part of a global shift in focus to greener fuel. Hydrogen is considered a promising decarbonization option for hard-to-electrify sectors such as heavy industry, shipping, and air transport. Applications for hydrogen include providing zero-emission fuels for long-haul transport and mining, providing feedstock to reduce greenhouse gas (GHG) emissions in heavy industries, offering flexibility to electricity grids and replacing natural gas in domestic gas networks.

Industrial companies are particularly well-suited for low-cost, large-scale hydrogen utilization given their substantial energy requirements and notable carbon emissions. They are responsible for more than one-third of the world’s energy consumption and a quarter of global CO2 emissions,

Hydrogen use is forecast to grow from 115 million metric tons currently to 500-800 million metric tons a year by 2050, accounting for 15% to 20% of total global energy demand. Hydrogen projects already announced represent over $300 billion in spending across the value chain and McKinsey analysts expect at least $150 billion of that spend to be related to hydrogen production.

An uplift in production is necessary to achieve environmental benefits at a global scale. However, the high cost of green hydrogen is currently a significant barrier to its uptake.

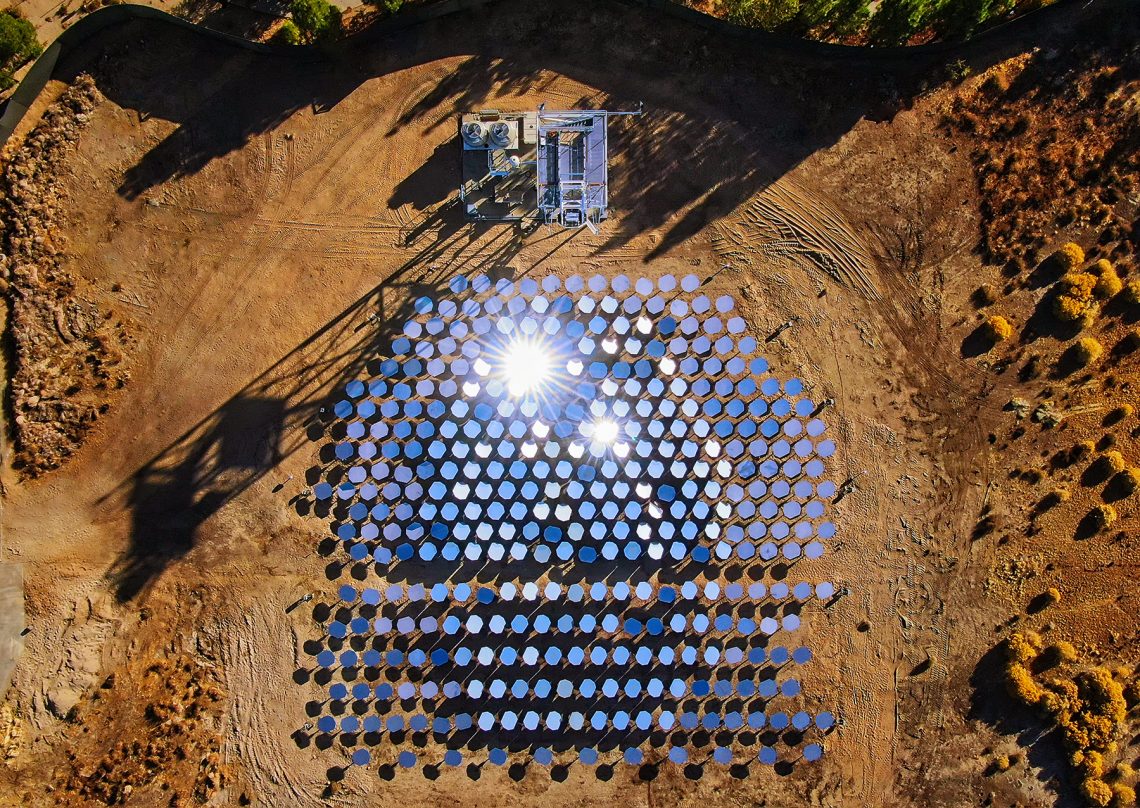

A technological leap is needed to make the economics work. Woodside is testing one it says it believes has potential: a modular, turnkey, AI-enabled concentrated solar energy system that aims to deliver clean energy at scale with nearly 24/7 availability. The technology was developed by Heliogen, a California-based scale-up founded by serial entrepreneur Bill Gros and funded by Microsoft co-founder Bill Gates and ArcelorMittal, one of the world’s largest steelmakers, among others.

It is yet another example of how collaborations between scale-ups and large corporations could help solve the U.N.’s Sustainable Development Goals.

Heliogen, which has raised $355.6 million to date, uses multiple movable mirrors to reflect sunlight in a fixed direction. The mirrors are controlled by AI to maximize concentration of the sun’s rays to generate temperatures at the point of focus that can exceed 1,000 degrees centigrade. This heat can then be captured, stored, and converted for industrial use, power generation, or to produce green hydrogen fuel.

In addition to Woodside, Heliogen is commercializing its technology with ArcelorMittal to produce greener steel and it is working with Rio Tinto, one of the world’s biggest metals and mining corporations, to decarbonize mining operations.

Heliogen’s goal is to avoid more than one gigaton of CO₂ emissions – 5% of the world’s annual total – by turning sunlight into an industrial energy source, says Gross.

If Heliogen’s technology scales it also promises to change the geopolitical landscape. For the first time renewable energy could be distributed through pipes or put on ships – in the form of green hydrogen – and moved across continents- shifting economic power to poor countries where the sun shines all year, Gross says.

Making The Physics and The Math Work

Hydrogen is the simplest and most abundant element in the universe. On Earth it rarely exists as a gas, so it needs to be separated from other elements. Producing it can be carbon intensive. It depends on the resources used.

Grey hydrogen is the most common form and is generated from natural gas, or methane, through a process called “steam reforming”. This process generates just a smaller amount of emissions than black or brown hydrogen, which uses black or brown coal in the hydrogen-making process, generating CO2 and carbon monoxide into the atmosphere.

Green hydrogen is a climate-neutral hydrogen that is produced by using clean energy from surplus renewable energy sources, such as solar or wind power, to split water into two hydrogen atoms and one oxygen atom through electrolysis. This is the method that Heliogen is promoting to make hydrogen.

When combined with a proprietary solid oxide, high-temperature electrolyzer developed by Bloom Energy, a World Economic Forum Technology Pioneer that has raised over $825 million from big name backers, Heliogen’s AI-enabled concentrated solar energy system can produce green hydrogen using up to 30% less electricity than low-temperature Proton-Exchange Membranes and alkaline electrolyzers, says Gross. The ability to use heat, which is a much lower cost source of energy than electricity, also improves the economics of green hydrogen production, Gross says. This is because heat is cheaper than electricity, which accounts for nearly 80% of the cost of hydrogen from electrolysis.

Currently, clean hydrogen isn’t scaling fast enough to deliver on its potential.

Gross says he is confident that will change. “All of these large companies are making commitments to reduce emissions by 2030, then the CTO goes around the world looking for solutions and the CFO asks if it is affordable. What has changed is the cost of renewable energy has gone down and the cost of fossil fuel has gone up so with scale we will finally be able to be competitive on a cost comparison basis,” he says.

Heliogen is working with Woodside Energy (USA), a wholly-owned subsidiary of Woodside Petroleum, on the building of a 5 megawatt commercial-scale demonstration facility in California, to prove that the technology and the math work. The proposed facility, which is expected to begin construction in 2022, will use advanced computer vision software that precisely aligns an array of mirrors to reflect sunlight to a single target on the top of a solar tower, thereby enabling low-cost storage in the form of high-temperature thermal energy. Heliogen’s customers can opt to build on the baseline system that provides industrial-grade heat by adding thermal energy storage systems, a turbine for power generation, and electrolyzers for green hydrogen production.

“Using electricity to produce heat can be inefficient,” says Jason Crusan, Woodside Energy’s Perth, Australia-based VP Technology. “If you can take heat and reflect energy into thermal energy storage and make the physics work, you can get double digit savings.” If Woodside is going to produce hydrogen from electrolysis it wants it to be green so that means it needs to use solar and wind or hydroelectric power, he says. Up to now the problem with using renewable energy was that the intermittent availability of sun and wind meant that it had to be supplemented by other sources, so-called “firming power replacements.” In the case of solar energy, which usually can fulfill about 20% of needed capacity, you need at least 5X the solar capacity with significant battery storage to run 24/7, says Crusan. It is expensive to store that energy in batteries, he says. Heliogen eliminates the need to store energy in batteries. Using AI to aim the mirrors could eliminate a lot of the inefficiencies of earlier thermal solar systems, he says, and enable power generation at higher temperatures, on average around 750 degrees.

“Heliogen’s innovative technology could play a key supporting role in development of Woodside’s zero-carbon hydrogen and ammonia business, which would rely on access to abundant and reliable renewable power,” says Crusan.

Steeling For Change

The power of Heliogen’s technology is that it can also power other industries, says Gross. Take steel. The industry’s impact on the environment is well documented. In 2020, on average, every ton of steel produced led to the emission of 1.851 tons of CO2 into the atmosphere. In 2020,1,860 million tons (Mt) of steel were produced, and total direct emissions from the sector were of the order of 2.6 billion tons, representing between 7% and 9% of global CO2 emissions, according to The World Steel Association.

Recent studies estimate that the global steel industry may find approximately 14% of steel companies’ potential value is at risk if they are unable to decrease their environmental impact, according to a McKinsey report on the decarborization challenge for steel.

It should come as no surprise then that companies like ArcelorMittal are taking steps to curb their emissions. To that end, in 2021 it created an innovation fund called XCarb, in which it anticipates investing $100 million annually. It announced, in May of last year, that its first investment would be in Heliogen.

In addition to ArcelorMittal’s $20 million investment into Heliogen, ArcelorMittal and Heliogen have signed a Memorandum of Understanding which aims to evaluate the potential of the scale-up’s products in several of the steel maker’s plants.

All three Heliogen products made from sunlight – heat, electricity, and clean fuels – are applicable to the steelmaking process and support the steel industry’s transition to carbon-neutrality. HelioHeat, for example, could be used to increase the temperature of air blown into a blast furnace, offsetting the use of fossil fuel. HelioPower could provide clean electricity to steel mills and HelioFuel – green hydrogen – could be used instead of natural gas as the reductant in the production of direct reduced iron.

In an interview Pinakin Chaubal, Chief Technology Officer, ArcelorMittal, said he believes solar power can play a key role in the production of steel. There are some limitations. Generating heat is dependent on the sun and carrying the heat generated by Heliogen’s mirrors over long distances is not efficient. But, says Chaubal, that does not mean that the use of Heliogen’s technology in steel plants is limited to sunny locations. For example, a plant in Spain might take advantage of the sun there. The sunshine could be converted to green hydrogen and then transported to other plant locations via existing hydrogen distribution networks in Europe.

Chaubal says he is hopeful that a plant location can be pinpointed this year to try out Heliogen’s technology, although it is likely to take longer before the first pilot becomes operational.

“There is tremendous potential,” says Chaubal. He cautioned that venture capital funding is not enough to help green technologies like Heliogen’s. Traditional industry and governments need to step in to make sure new green technologies scale and costs come down, he says.

How Mining Might Extract Value From Solar

Heliogen’s high-temperature solar technology can also cost-effectively replace fossil fuels with sunlight in other industrial processes, including those used in mining.

In March of 2021 international mining and metals company Rio Tinto announced an agreement to explore the deployment of Heliogen’s technology at its borates mine in Boron, California.

The site, which covers about 20 square miles, burns a huge amount of natural gas and electricity, says Gross. Under a Memorandum of Understanding, Heliogen will use heat from the sun to generate and store carbon-free energy to power the mine’s industrial processes. The two companies will begin detailed planning and securing government permits for the project, with the aim of starting operations in 2022. The companies will also use the Boron installation to begin exploring the potential for deployments of Heliogen’s technology at Rio Tinto’s other operations around the world to supply process heat, which accounted for 14% of Scope 1 and 2 emissions from the Group’s managed operations in 2020.

At Rio Tinto’s Boron mine, solar energy captured by Heliogen will be turned into steam and also to generate heat used to power night operations, providing the same uninterrupted energy stream offered by legacy fuels.

The Boron operation mines and refines borates into products ranging from fertilizers to construction materials and is producing lithium carbonate from a demonstration plant. The site currently generates steam using a natural gas co-generation plant and natural gas fired boilers. Heliogen’s installation will supplement these energy sources by generating up to 35,000 pounds per hour of steam to power operations, with the potential to reduce carbon emissions at the Boron site by around 7%, the equivalent to taking more than 5,000 cars off the road.

In a statement Rio Tinto said it also plans to assess the potential for larger scale use of the Heliogen technology at Boron to reduce the site’s carbon footprint by up to 24%. Using Heliogen’s technology can turn the Boron site into “a zero-emission facility and they will save money,” says Gross. Once the deal became public “nearly every mining company called us,” he says.

A Chance For Real Impact

In December Heliogen finalized a $39 million award from the U.S. Department of Energy to deploy the company’s technology in California and announced a collaboration with CarbonCapture, a company specialized in direct air to carbon (DAC), a technological method that uses chemical reactions to capture CO2 from the atmosphere.

Both Heliogen and CarbonCapture were founded under a decarbonization mission: Heliogen to decarbonize industry and CarbonCapture to decarbonize the atmosphere. The companies work toward complementary ends — Heliogen in reducing the pace and quantity of industrial carbon emissions and CarbonCapture in removing legacy emissions from the atmosphere. Both companies grew out of Idealab Studio, another venture founded by Gross. The aim is to harness the industrial heat production capabilities of Heliogen systems for use in CarbonCapture’s direct air capture systems.

The chance for solar to make a real impact has never been greater, says Gross, who started his first company, Solar Devices, in high school during the 1973 energy crisis. He sold more than 10,000 kits and plans for solar energy products in the back of Popular Science magazine, helping him pay his way through the California Institute of Technology. Since graduating with a degree in mechanical engineering in 1981 Gross has started many solar energy companies, including eSolar, Energy Innovations (acquired by Suntech), RayTracker (acquired by First Solar), Thermata (acquired by Solar Reserve) and Edisun Solar Microgrid. Harnessing solar to help industrial sectors like steel, cement and mining go green will put a major dent in GHG emissions, he says. Together these three sectors alone emit 10x the amount of all of the world’s airplanes combined. “It’s a huge opportunity,” says Gross.

This article is content that would normally only be available to subscribers. Sign up for a four-week free trial to see what you have been missing