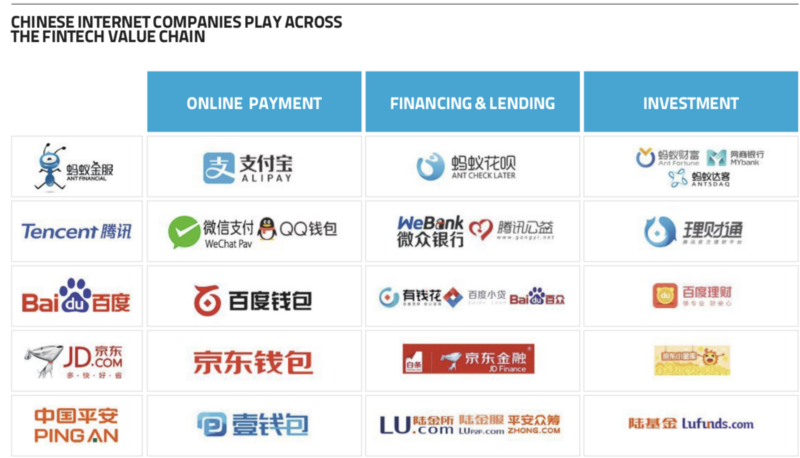

China has become the center of global fintech innovation and adoption. And it is expected to be a major influence on the way financial services are delivered in future. “China’s heady mix of rapid urbanization, regulatory acquiescence, a massive and underserved SME market, escalating e-commerce growth, and explosion in online and mobile penetration, have created a fertile ground for innovation in commerce, banking and financial services more broadly,” says a report by EY. While not all of the innovations can be replicated in the West, they are expected to be a major influence on the way financial services are delivered in the future. “A lot of people in the banking and financial services industries are pretty freaked out because they don’t understand how profound and deep all these changes are and that it is happening so quickly,” says Paul Schulte, founder and editor of Schulte Research, a company that does research on banks, financial technology, bank algorithms and credit algorithms. The disruption doesn’t just impact banks. “It is impacting brokers, dealers, retail and commercial banking — it is everything,” says Schulte. Chinese fintech activity spans seven key vertical markets which were outlined in the EY report:

Payments and e-wallets

A mobile payments ecosystem facilitated by e-commerce and social media players, of which Alipay (of Ant Financial) and Tenpay (a Tencent company) dominate the market. Other notable players include UnionPay, ICBC e-wallet, JD Pay/Wallet (of JD.com) and 99bill (of Dalian Wanda Group).

Supply chain and consumer finance

E-commerce players lend to underbanked or unbanked individuals and small medium enterprises (SMEs) by leveraging users’ merchant data on the platform. Key participants include Ant Financial and MyBank (Alibaba), WeBank with WeChat (Tencent), JD Finance (JD.com) and Gome Electronic Appliances, which recently ventured into providing financial services for individual customers and suppliers.

Peer-to-peer (P2P) lending platforms

P2P platforms create a marketplace for peers to lend to individuals and SMEs underserved by the traditional lending sector. Market leaders are Lufax (Ping An Insurance), Yirendai (CreditEase), Rendai, Zhai Cai Bao (Alibaba) and Dianrong (the co-founder of Lending Club).

Online funds

Funds linked to payment platforms that offer ease of access and more competitive returns than the historically low deposit rates. Primary participants are Yu’e Bao of Ant Financial, Li Cai Tong (Tencent) and Baifa (Baidu).

Online insurance

E-insurance sold through e-commerce and online wealth management (via platforms). Notable brands are platforms by the People’s Insurance Company of China (PICC), Ping An, and Zhong An (in partnership with Ping An).

Personal finance management

Recently developed mobile-centric finance solutions providing access to mutual funds through stock trading apps. These platforms offer offline-to-online activity, with online brokers accounting for over 92% of new clients. Key players include Ant Financial (Alibaba), Li Cai Tong (Tencent), Baifa (Baidu), Wacai, Tongbanjie, Zhiwanglicai (CreditEase) and JD Finance (JD.com).

Online brokerage

Investment, social network and information portals for investors in China, providing thematic investing via websites and mobile apps, and offered by fintech firms such as Snowball Finance, Xianrenzhang and Yiqiniu.

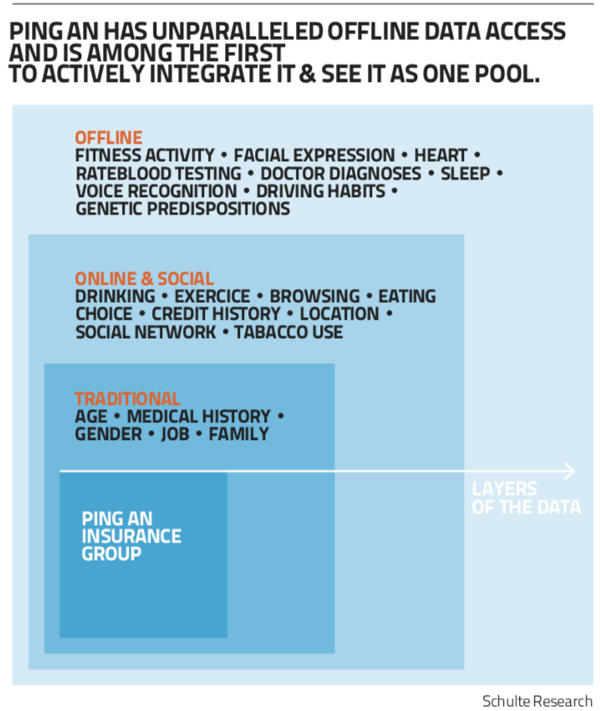

These offerings are being greeted with enthusiasm by digitally savvy consumers who have few reservations about sharing personal information, creating opportunities for fintech firms and incumbents willing to take on digital transformation, says the EY report. Fintech firms are targeting both the under- banked or unbanked populations of small and medium enterprises and consumers with unmet needs as well as the demands of the burgeoning middle class for wealth management, insurance and private banking. To meet these needs Chinese technology giants Baidu, Alibaba, and Tencent are aggressively creating all-encompassing platforms with the aim of embedding their services — financial and non-financial solutions — into customers’ lives. And once China’s nationwide Social Credit System (SCS) is in place, the potential of China’s fintech market will open up even further, projects the EY report. The SCS, which is expected to be operational by 2020, will assign a credit score to every citizen and business in China based on their financial and social behavior. Ahead of the SCS, China’s National Internet Finance Association has just launched its Internet Financial Industry Information Sharing Platform, accelerating the entry of credit scoring into the Internet finance fold. Meanwhile Pingan, which is active in insurance, banking and asset management, has been successfully bridging online and offline data and a move into digital services, using cutting edge technologies such as artificial intelligence and blockchain. It has spawned a number of huge digital players such as peer-to-peer lender Lufax, Ping An Good Doctor, a healthcare portal with 30 million plus monthly active users whose recent IPO raised $1.1 billion in Hong Kong; as well as Ping An Healthcare and Technology, a mobile app for booking hospital visits used by 800 million customers across China. Traditional financial services companies — both in and outside China — need to take note of all of these innovations in financial services in China, says Schulte. “Chinese companies are developing purely digital financial activity in every part of the financial system. It is really remarkable that traditional financial institutions have not yet gotten with the program and started the aggressive, deep and wide reform or change that is required in order to counter guys like Alibaba, TenCent and PingAn,” says Schulte.