PingAn, one of China’s largest insurers, with a market cap of $180 billion, decided five years ago to morph from a financial services company to a technology company with financial services licenses. This radical re-articulation of its business model now drives everything it does.

The Chinese company “realized that re-allocating capital and resources to a platform-based strategy was the best way to create new growth and value in the digital economy,” says Simon Torrance, an independent advisor to boards on business model innovation and a member of the World Economic Forum’s Digital Platforms & Ecosystems executive working group. “It then boldly executed against this epiphany in ways that few — if any — traditional incumbents elsewhere have done.”

The company’s structure today is very different from the one that chairman and CEO Peter Ma started 30 years ago, says Jonathan Larsen, Chief Innovation Officer of the Group.

“Peter Ma always took the view that there was enormous value in having licenses in adjacent financial businesses and and those licenses to this day have the widest range of financial services in a chain that includes a bank,” says Larsen. “We have a whole range of new generation fintech businesses as well.”

Today there are 32 businesses in the group and only two are material acquisitions, he says. “Every other business has been grown from nothing. That’s the culture of PingAn, to grow the business from a standing start.”

The next phase of the company was all about market share and volume growth rather than shareholder value, says Larsen. The focus was on the right product mix, smart risk taking and the right sales and service models.

Ma made a crucial decision to pivot from products to client services early on and integrated all of PingAn’s call centers and all of its customers communications in one place, integrated databases across every single entity. “The next phase was really using this businesses to pivoting the whole company around client services,” says Larsen.

Ma watched Alibaba and TenCent emerging as significant players in China using completely new business models that would have a transformative effect and offer a whole range of opportunities which the offline world would not be able to capture. At that point PingAn began its journey to becoming a deep technology company, Larsen says. The company decided to very quickly digitize everything it did. “If you became a PingAn insurance agency you were recruited online, trained online, and your customer relationship management software was driven by mobile and tablets and your customer marketing integrated into social networks,” says Larsen. “To this day I am unaware of any company that does everything digitally end-to-end the way PingAn does.”

PingAn then decided not only to move all of its operations onto the cloud but to create its own cloud. “We have 180 million financial clients, 500 million digital users across all of the proprietary eco-system,” says Larsen. “This was a really, really significant thing to do. The simplification it achieved and the integration of what previously was connected but separate technology allowed a different level of agility and cost-effectiveness.” From there the company started to invest into a range of new technologies that were transformative.

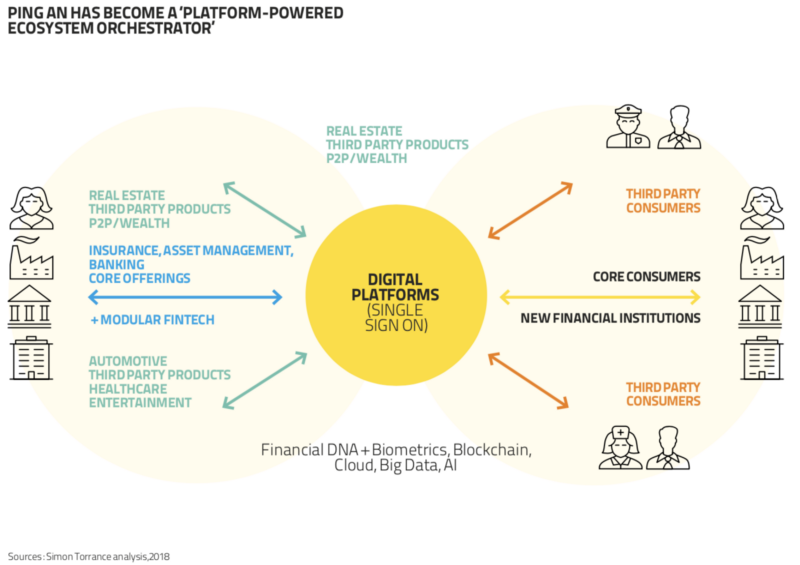

PingAn has used the platform model to branch out from insurance, banking and asset management into healthcare, automotive and entertainment. (See the chart).

And the company’s early embrace of cutting-edge technology has helped PingAn increase efficiency, reduce costs, improve customer experience, strengthen risk management, and sharpen the group’s competitive edge.

For example, the company helped pioneer the use of facial recognition technology. “That allowed us to eliminate ID fraud in China and build our own voice print technology so when you contact one of our call centers we know who you are from the moment you open your mouth,” says Larsen.

PingAn claims to be the first in the world to apply micro-expression recognition technology in its lending arm. Over 500 billion yuan in loans have been facilitated using the technology, says the company, helping it cut credit losses by 60% and shorten the approval time from five days to two hours.

The company has also launched dozens of start-ups focused on areas such as medical care, financial technology, online car sales and artificial intelligence.

One of the conglomerate’s start-ups, OneConnect started as an internal unit that developed financial technology for the group. It has since launched an outward-facing business that sells such technology to small banks, insurance companies and non-bank financial institutions around China.

Based on four core technologies, biometrics, AI, blockchain and cloud computing, OneConnect provides intelligent solutions in sales, risk management, products, services and operations to 483 banks, 42 insurance companies and 2,400 non-bank financial institutions nationwide. In 2018 OneConnect started introducing the technological solutions to overseas markets. Today, OneConnect is serving financial institutions in Thailand and Indonesia, among other South East Asian markets, putting OneConnect on the map of global competitors in fintech.

Expect the company to continue moving into adjacencies. “It is healthy to keep evolving as an organization and be unafraid to cannibalize your own business to create something better,” Larsen says.