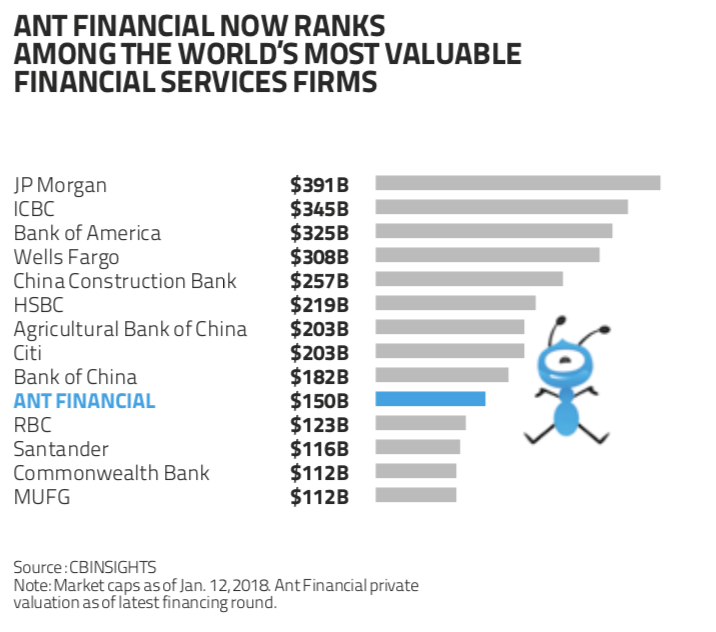

Ant Financial, which got its start powering Chinese Internet giant Alibaba’s e-commerce platform and was later spun out as as separate business, demonstrates how platform business models allow companies to successfully extend into adjacent businesses. Alibaba used its original business — ecommerce — and technology to move into payment solutions. The payments business begat Ant Financial, which today has a valuation of around $150 billion, making it one of the most valuable financial companies in the world.

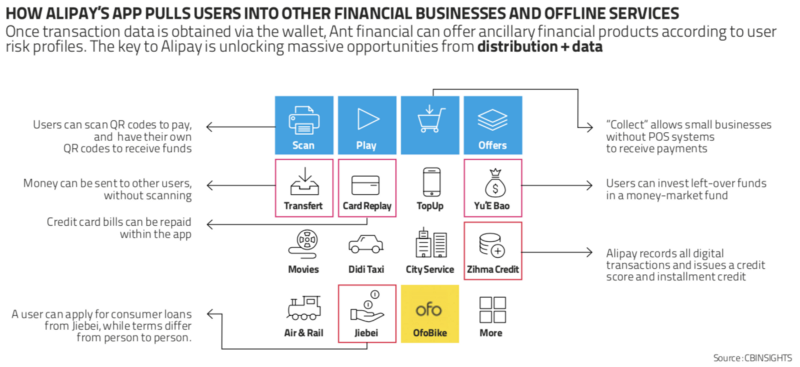

Ant Financial grew out of Alipay, a mobile and online payment platform that launched in 2004 and contributed significantly to Alibaba’s ability to succeed. “Alipay was initially established as a third-party escrow service to bridge the gap in trust between online buyers and sellers,” says Douglas Feagin, president of Ant Financial’s International Business Group. “By utilizing this escrow account, complete strangers became comfortable transacting online with each other. Once our users were able to conduct e-commerce, they naturally developed other needs such as financing, wealth management and insurance, which motivated us to offer an innovative suite of these services built around the core payment use case.”

Recently Ant Financial launched a new brand devoted to yet another adjacent business: providing advanced technology services to financial institutions. “Whenever we decide to move into a new area, our first consideration is always whether it is a solution that our clients need, that no one else has been able or willing to provide,” says Feagin. “This stands in contrast to the traditional metrics of whether a new service has the potential to become a profit-making business.”

An Open Platform, Driven By Technology And Ambition

At press time Ant Financial was rumored to be in advanced talks to buy U.K. currency transfer service WorldFirst. The Chinese company, which previously tried and failed to buy Moneygram, a U.S. money transfer service, said it could not comment.

Ant’s current business operations include:

* Alipay: The biggest player in China’s $17 trillion online payments market, handles transactions on Alibaba’s Taobao and Tmall e-commerce platforms but has evolved into a lifestyle enabler. Users can hail a taxi, book a hotel, buy movie tickets, pay utility bills, make appointments with doctors, or purchase wealth management products directly from within the app. In addition to online payments, Alipay is expanding to in-store offline payments both inside and outside of China. Alipay’s in-store payment service covers over 40 countries and regions across the world, and tax reimbursement via Alipay is supported in 29 countries and regions. It also works with over 250 overseas financial institutions and payment solution providers to enable cross-border payments for Chinese travelling overseas and overseas customers who purchase products from Chinese e-commerce sites. Alipay currently supports 27 currencies.

* Yu’e Bao: What began as an online spare cash management platform within the Alipay app that enables users to efficiently manage their spare funds to make online and offline purchases has morphed into the world’s largest money market fund with more than $200 billion in assets.

* Ant Fortune: A wealth management platform launched in 2015 that uses technology to connect financial institutions with individual users who have little financial expertise and helps them understand wealth management products and services. Through Ant Fortune’s platform and Alipay, users can purchase these products as well as obtain market information, participate in forums, and access other services. Ant Fortune also aims to address the needs of financial institutions that lack efficient channels to engage with and understand the needs of users, through innovations such as AI-powered operational optimization, marketing, and risk management. More than 110 mutual-fund asset management companies in China have joined the platform, providing over 4,000 products to tens of millions of Ant Fortune users.

* Ant Insurance: Founded in 2015, the Ant Insurance Services Platform provides technology services to insurance companies who serve consumers and small businesses. More than 70% of Ant Insurance employees are technicians working on innovative technologies to support the insurance industry. As of January 2018, more than 100 insurance companies in China had used technology offered by Ant Insurance to collectively service 510 million customers.

* Zhima Credit: An independent, private, alternative credit service that aims to bridge the “trust gap” between consumers and businesses by assessing individuals’ willingness and ability to fulfill a commercial contract. Users with higher Zhima Credit scores have access to benefits such as deposit waivers when renting a bike or staying at a hotel.

* Jiebei: Launched in April 2015, is a consumer finance product that Alipay users can use to meet short-term cash needs. Borrowing quotas[JC1] differ from user to user.

* Huabei: Launched in December 2014, it offers a revolving line of credit to Alipay users for purchases with online and offline businesses.

* MYbank: A private online bank established in June 2015, is the first bank in Chinato run entirely on the Cloud with no physical branches. At the end of August, MYbank and its predecessor, Ant Micro Loan, had served the financing needs of 11 million small businesses in China.

* Ant Financial Technology, launched in September of 2018, it offers large-scale transaction technologies, security technologies, intelligence technologies, next-generation interaction technologies and blockchain applications to financial institutions.

Even before the launch of a specific technology brand aimed at the financial industry, the company says Ant Financial’s technology products and services have improved efficiency and lowered costs at approximately 200 financial institutions, including more than 100 banks, over 60 insurance companies, and more than 40 asset management firms and security brokers.

Xi Hu , the company’s deputy chief technology officer, notes that Ant Financial’s technologies have withstood the tests of some of the world’s most extreme use cases through in-house use. For example, in the large-scale financial transaction portfolio Alipay, Ant Financial’s mobile payment and lifestyle platform, was able to process a record breaking 256,000 payment transactions per second at the peak of the 2017 Singles’ Day Shopping Festival.

In May 2018, several banks signed strategic cooperation agreements with Ant Financial to support their digital transformation. And, a month later, Ant Financial announced that it would share a full suite of artificial intelligence capabilities with asset management companies to increase operational efficiency and reduce costs.

“Our mission is financial inclusion — we believe that financial services should be easy to use, low cost and available to the many, not the few,” says Ant Financial’s Feagin. “We can only achieve this objective through an open platform, driven by technology. We work closely with a diverse group of partners who create a range of products and services to serve the widest possible customer base.”

Simon Torrance, author of The New Growth Playbook and a member of the World Economic Forum’s Digital Platforms & Ecosystems executive working group, says established companies can learn a lot from Ant Financial.

“Facilitating payments is just the hook to enable Ant Financial to offer high margin technology services and reap even higher margin marketplace fees from the ecosystem they are curating,” says Torrance. “Their open platform approach, enabling competitors as well as their own internal product teams to transact and innovate efficiently, puts them at the center of a self-reinforcing and self-sustaining flywheel for new growth and value creation. Leaders of traditional companies need to rapidly learn these new principles of business or be left behind in an increasingly hyper-connected world.”