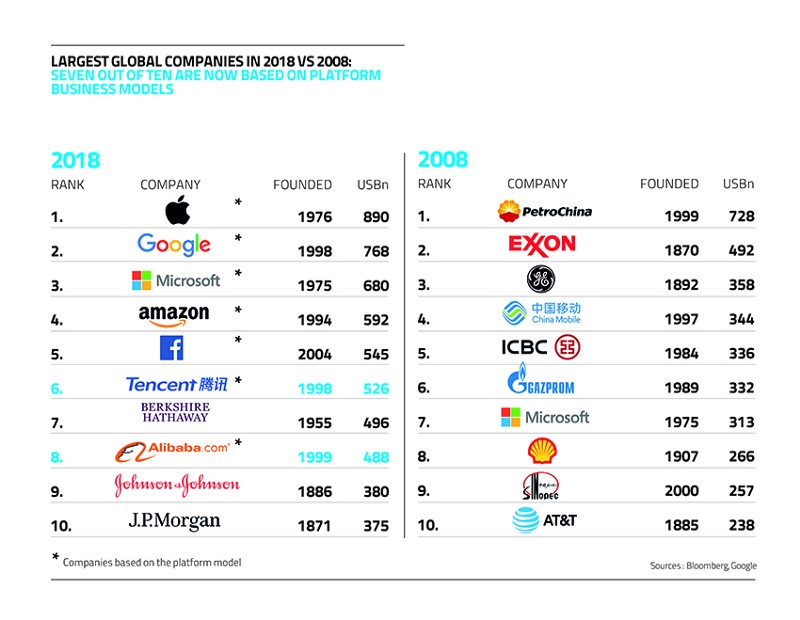

Seven of the 10 most valuable companies globally are now based on a platform business model: the creation of digital communities and marketplaces that allow different groups to interact and transact. Companies like Apple, Google, Amazon and Alibaba have used the model to grow exponentially and grab significant market share from established firms.

Platforms represent a big change in the way industries have traditionally been organized. And first mover advantage is important in an environment where the winner often takes all.

But all is not lost. Experts say established companies have the chance to create platforms of their own or, at the very least, to become part of another platform’s ecosystem.

Experts say that established companies have the chance to create platforms of their own, partner to jointly create platforms, or figure out how to leverage other platforms to their advantage.

« The bulk of the power in industries is likely to shift to ecosystems, » says Geoffrey G. Parker, a Dartmouth College professor and Massachusetts Institute of Technology (MIT) research fellow and business author who regularly advises C-Suite executives on platform strategies. « So the message is every firm needs to understand platforms and figure out their place in the industry structure that is coming. »

More than 30% of global economic activity — some $60 trillion — could be mediated by digital platforms in six years’ time, according to a McKinsey research report, and yet experts estimate only 3% of established companies have adopted an effective platform strategy.

It is no surprise, then, that the platform economy will be on the agenda at the World Economic Forum’s annual meeting in Davos, Switzerland January 22–25.

“Big companies are struggling with if and how to leverage digital platform and ecosystem models for their industries,” says Cristian Citu, the Forum’s Digital Transformation Lead. “They are asking how do I create a core platform that will deliver on the promise of exponential growth? Network effects are very tricky. They need to learn how they can work in this new world of ecosystems which requires a completely new way of dealing with customers, partners and traditional competitors.”

Over 50 large corporations are participating in a World Economic Forum’s Digital Platforms & Ecosystems executive working group, part of the Forum’s Digital Economy and Society system initiative. Members of the committee’s Rotating C-Level Steering Committee include Allianz, Booking.com, Deutsche Bank, GE, Henkel, Huawei and Klöckner. B2B platforms could represent $10 trillion in socio-economic value creation from 2016 to 2025, according to an Accenture report compiled in partnership with the Forum. The report notes that this estimate, derived from a larger forecast which estimates $100 trillion of value is at stake through 2025 may, in fact, be conservative.

European companies in sectors as diverse as steel distribution, energy, corporate pensions, cement, insurance and even door manufacturing are starting to embrace platform business models. And a whole industry is emerging to help them.

The MIT Initiative On The Digital Economy holds its annual Platform Strategy Summit. Europe launched its own conference on the topic — the Platform Economy Summit — on November 20–22, in Berlin. The executive producer of that conference, U.K. national Simon Torrance, an independent advisor to boards and leadership teams on business model transformation, has designed an online education program to help leaders understand the key principles of platform-based business model transformation called The New Growth Playbook. MIT’s Parker, Marshall N. Van Alstyne and Sangeet Paul Choudary co-authored a book entitled Platform Revolution: How Networked Markets Are Transforming the Economy and How to Make Them Work for You, while French nationals Laure Claire Reillier and Benoit Reillier, co-founders of a London-based consultancy called Launchworks that specializes in helping companies adopt, design and scale platform business models, co-authored a book in both English and French entitled Platform Strategy: How to Unlock The Power of Communities and Networks To Grow Your Business.

“Boards and leadership need to understand in much greater depth the economics of platform business models and how to operate them,” says Torrance, a member of the Forum’s Digital Platforms & Ecosystems executive working group. “Platforms will mediate more and more socio-economic activity. There are plenty of high value niches available to be grabbed by existing businesses. But, while 90% of corporate leaders are saying — anonymously in surveys — that they know their current business model is not fit for the future, very few are acting fast enough to create platform strategies that can meaningfully impact their performance.”

The reason more companies are not adopting platform strategies is that this model is not something that today’s corporate leaders were taught at business school, says Torrance. “Very few leaders at non-digital companies understand, to a profound degree, business models like this and even when do they do it takes time to percolate through the strategy process,” he says. “In a really connected world what a platform business does is to optimize supply and demand between the producers of certain goods and services and consumers. It orchestrates those interactions and makes them more efficient — just like farmers’ markets or stock exchanges do. In a digital world you can put many, many more types of people together, as eBay and then Apple, Facebook, Amazon and Alibaba, have demonstrated. European companies are starting to wake up but they are five years behind and their cultures are certainly not digital.”

Why Companies And Countries Need To Embrace Platforms

While many established firms believe that platform models are only relevant in a business to consumer (B2C) context, it is the business to business (B2B) world that is currently seeing the most activity,” says Launchworks’ Laure Claire Reillier, a former senior executive at eBay Europe who has worked for a number of high-growth startups and established tech firms. She cites as examples recent B2B platform developments in many verticals (Siemens’ EasySpareParts marketplace), boutique law firm services (Lexoo), and office supplies for businesses (Amazon Business marketplace)..

Reillier sees B2B and B2C platforms emerging in many sectors including retail, education, healthcare, transport, agritech, fintech and real estate.

Business author Choudary, a World Economic Forum Young Global Leader and publisher of a blog called From Pipes to Platforms, believes platform business models will also be adopted in logistics, manufacturing and industries that rely on heavy engineering. “Blockchain and digital ledger-based initiatives will be an important starting point to creating interoperability in traditional industries and, over the coming years, we will see new platforms coming up around these initiatives,” he says in a blog posting.

He makes a case for why not only companies but countries need to pay attention to platform models.

The platform economy is reshaping global trade, he says. Global small and medium-sized business trade is on the rise, driven by the growth of platforms such as Alibaba, which allow much smaller enterprises to participate in global trade, without the need to invest in their own supply chains. As these platforms scale, control over trade could shift from countries to these digital platforms. In a world dominated by platform companies that offer ways for customers and companies to connect, countries that want to act as global trade hubs must think like a platform nation, Choudary said during a presentation at the Platform Economy Summit in Berlin.

Key Takeaways From The Most Successful Platform Plays

So what can traditional companies learn from platform players? In China an example of a traditional corporation transforming its business model is PingAn, an insurance company that decided five years ago to reframe itself as a technology company with financial services licenses as a way of embedding itself more deeply into more aspects of peoples’ everyday lives. “They have created a portfolio of platform businesses that are directly related to insurance: in healthcare, connecting patients with doctors; in automotive for buying and selling cars; and even in entertainment,” says Torrance. “Thanks in part to these moves, PingAn is now the most valuable insurance company in the world.”

In South Africa Naspers, a 100-year-old company, transformed from being a printer of newspapers to a digital and platform company in the last five years. It took a stake early on in Chinese Internet giant Tencent that is now worth more than the whole of all their companies combined, built up a global online classified business called OLX and acquired a stable of tech and platform businesses like food delivery startup Delivery Hero.

Torrance says American incumbents are starting to be bolder. He points to Walmart’s acquisitions of Jet.com and Flipkart. “These have already started to pay dividends,” he says. “Walmart has moved from 15 million SKUs (stock keeping units or unique items for sale) to 60 million. That sums up the power of creating a platform. By having a system that allows and incentivizes others to plug into it, Walmart could quadruple the number of SKUs offered to customers without taking on inventory risk. This is essentially what Amazon did 18 years ago — let other people fulfill their customer requirements and rent out their infrastructure to enable it. This results in stickier customers and a lower cost structure funded by others.” General Electric (GE) has been using platform thinking for a different purpose. It wanted to figure out how other people could develop useful applications that would help customers leverage GE’s increasingly connected machines. So, GE decided to create an ecosystem of innovators to create digital solutions for customers. The idea was that GE Digital would be at the heart of this platform and generate significant new revenue streams from the platform. “The vision was excellent and GE was a trailblazer for traditional corporates but unfortunately GE Digital was established in a pretty traditional way within an organization that has big fundamental challenges,” Torrance says.

“The evolution of GE Digital is still being written,” says Karthik Suri, General Electric’s Chief Operating Officer and a member of the Forum’s Digital Platforms & Ecosystems’ Rotating C-Level Steering Committee. He cites three lessons the company learned from being a B2B digital pioneer: Rather than build your own data centers, partner with technology companies and focus on your core competency; volume isn’t necessarily a goal on B2B platforms, focus instead on strong partnerships with the people you want to reach in your sector; the best way to prompt the necessary cultural change is to pair digital natives with the company’s in-house industry experts.

“Transforming an incumbent business model to be fit for a digital economy is very hard,” says Torrance. “If you look at the top 1,000 publicly traded companies worldwide the amount traditional companies have invested in platform strategies — the most powerful digital business model — is still tiny. You need to boldly re-allocate capital and resources if you want to be able to play in this market.”

How To Get Started

So what steps should corporates take to get started? Don’t try to develop a platform strategy entirely within the existing corporate structures, warns Torrance. “It will fail due to cultural challenges and existing metrics. Create a separate unit to invent the future, allow it to work in a different way and, crucially, have it report directly to the CEO, not the core, otherwise any innovation will be stifled and killed,” he says. Try new approaches, like joint ventures with entrepreneurs, to grab opportunities fast before they disappear and to build up experience and knowledge, he advises. “One of the best methods is to proactively create joint ventures with proven tech entrepreneurs whereby the entrepreneurs can leverage a corporate’s assets but don’t have to work for the corporate,” he says. One example is Factor10, an independent corporate company builder, which is working with European energy provider Vattenfall and other incumbents. Factor10 is a member of the Forum’s Platform Economy executive working group.

“Nowadays there are more and more entrepreneurs who have experience of creating and scaling platform business models, who may have recently exited a venture and are looking for the next big thing but don’t want to start from scratch,” says Torrance, a venture partner at Factor10. “Big corporates are very slow to change their internal culture and can’t move very quickly, but they have cash and great assets. So it makes sense to create a portfolio of joint venture ‘speedboats’ with successful entrepreneurs to grab new ‘white space’ market opportunities fast. This model is relatively new but proving very popular.”

Hybrid Models

Not all companies require a full move to a pure platform model, says Launchworks’ Laure Claire Reillier. “More often than not, we see the need to shift towards a hybrid model, or what we call a platform-powered ecosystem, in which the existing traditional model of the firm is supplemented by a platform business for some activities, as a key success factor for differentiation,” she says. For example, a manufacturer could add a marketplace of spare parts or a platform of complementary value-added services. A retailer could supplement its inventory with a long tail of complementary products.

This combination of traditional models and platforms is at the heart of many successful businesses, says Reillier. Apple uses a value chain to produce its hardware — raw materials are transformed into phones and laptops that are then sold at a margin. But increasingly the value of the firm is driven by its millions of apps, through the platform app store. “The beauty of a platform-powered ecosystem is that the combination of businesses — phone and app store — is worth more than the sum of its parts,” she says. “In fact, this is the rationale behind Apple’s decision to stop reporting hardware sales. They want analysts to start assessing them on the health of their ecosystem — and the margin generated — rather than the number of products sold.”

Platform 2.0

Established companies not only have to play catch-up, they may have to leapfrog since some of the best-known Platform 1.0 platforms, including Amazon, Facebook and Google, are now heavily investing and developing AI [artificial intelligence] and blockchain technologies that will help them create Platform 2.0 models, says Reillier. She notes that Amazon Web Services has recently launched two new blockchain products for its Cloud offering, while Google Cloud’s division is catching-up fast. There are also many rumors surrounding Facebook’s growing blockchain team and what their leader David Marcus might be working on.“The question is: will today’s successful Platforms 1.0 use these new technologies to simply make their current platform model more efficient or will they enable different, more decentralized, more transparent, more cooperative new business models, where governance principles are co-developed by the community,” says Reillier. “Smart contract ecosystems like Ethereum pave the way to enable new organizational models that we call Platforms 2.0. We are at the very beginning of this trend, and probably a few years before widespread adoption, but it is important to keep an eye on this next wave of disruption.”

State of Play

The adoption of a platform model — like Amazon with its marketplace, Apple with its appstore, or Alibaba from birth — should mean a big improvement in financial performance metrics. This is why you see car companies investing in ride hailing or other platform business models, says Torrance. “But these are still relatively tiny, tiny investments and they are not really moving the needle because full commitment to the principles of the platform business model are not there yet,” he says. Germany’s Klöckner has invested in an open digital platform to try and help the whole steel distribution market operate more efficiently. But, it is very early days. On the industrial side, Schneider Electric, Bosch and Siemens are launching new IoT platforms, but these are still very technology focused. “I really can’t point to a European company today and say that company has taken bold shifts to radically transform their overall business model with a platform strategy. Less than 2% of companies have committed to bold platform-based growth strategies let alone proved their ability to successfully implement them,” Torrance says.

Will Open Innovation Platforms Help Corporate Europe Move Forward ?

Research shows that the U.S. and China have created more and larger platform-enabled businesses and that Europe is not investing enough in new business models. But Rahymn Kress, Chief Digital Officer and Chairman of the Digital Executive Committee at Henkel, a 143-year-old German conglomerate, says he remains bullish on Europe.

In addition to overseeing his own company’s digital transformation Kress has launched HenkelX, an open innovation platform that brings together a diverse network of partners and experts sharing knowledge, views and ideas. “It is an agile, hyper-connected and entrepreneurial platform for collaboration and innovation,” he says, and its aim is to help the entire European market move forward by collectively driving industrial business models.

Henkel joined the Forum’s Digital Platforms & Ecosystems’ Rotating C-Level Steering Committee because it, too, is acting as a kind of platform for collaboration on business models, he says. “The initiative brings together global representatives from corporations and start-ups as well as academia and government, policy-makers and policy shapers, who share an interest in how digital platforms operate, how corporations are looking to set up digital businesses and engage in ecosystems, as well as understanding the complexities related to trust and governance surrounding digital platforms and ecosystems,” says Kress. “It is clear that platforms will bring about transformational change, but there are a number of challenges that must be addressed. And the Forum has taken the initiative to confront these challenges. Platforms are hard to build and leaders must establish an environment in which they can flourish. The rapid pace of technological progress, cultural and organizational transformation, outdated regulations and irrelevant metrics are key priorities for policy-makers and business leaders to address.”

Thanks to HenkelX and the Forum executive working group, Kress says he thinks that in 2019 “we will see a by far more engaged corporate Europe that has understood that there are big opportunities and also threats if corporates don’t engage.”