No longer only the domain of science fiction, artificial intelligence

is poised to impact everything from how steel is produced to the way

women buy bras and farmers grow lettuce. It will change what we do

during our commutes and how we move around cities.

It will not only eliminate jobs, it looks poised to wipe out entire professions

and change the ones that remain. And it could be the deciding factor in

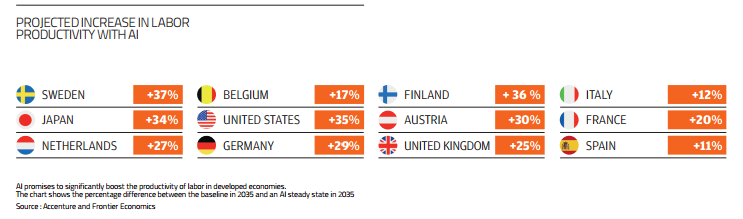

how quickly major economies grow. Accenture analyzed 12 developed

economies, and found that artificial intelligence, or AI — technology that

allows computing systems to sense, comprehend and act — has the

potential to double their annual economic growth rates by 2035. Europe

was left behind during the last digital revolution, but AI could give it –

and traditional companies — the chance to regain ground and even leap

ahead of disruptors and other regions, says Charles-Edouard Bouée, CEO

of Roland Berger, Europe’s largest management consultancy.

Some call AI the next industrial revolution, and it is not just hyperbole.

Within 10 years AI and robotics are expected to create an estimated

annual “creative disruption impact” of up to $33 trillion globally, including

$8 trillion to $9 trillion of cost reductions across manufacturing and

healthcare, $9 trillion in cuts to employment costs due to AI-enabled

automation of knowledge work and $1.9 trillion in efficiency gains via

autonomous cars and drones, according to a Bank of America Merrill

Lynch report. The report predicts adoption of robots and AI could boost

productivity by 30% in many industries, while cutting manufacturing costs

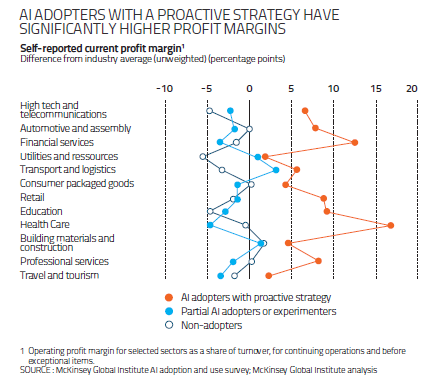

by 18% to 33%. A report due to be released June 15 by the global

management consultancy McKinsey & Company says AI is already helping

early adopters of the technology increase margins by up to 15%.

Growing Investment in AI

AI investment is growing fast, dominated by digital giants such as Google

and Baidu. Globally, McKinsey estimates $18 billion to $27 billion was

spent on R&D and deployment by corporates in 2016 alone, primarily by the online giants. A further $2 billion to $3 billion was spent on AI acquisitions, partially in a quest to secure data and talent. VC and private equity investment also grew rapidly, albeit from a small base, to a combined total of $5 billion to $8 billion. That said, actual adoption of AI is still relatively low, partly because only 12% of AI’s most promising applications have yet to be commercialized, says Eric Hazan, a McKinsey senior partner and a co-author of the report.

Disruption Across Sectors

Still, in an Infosys poll released in January of 1,600 senior executives at large companies across seven markets, 76% of the respondents said they believe AI will be fundamental to the success of their organization’s strategy and 64% said they believe that their organization’s future growth will be dependent on large-scale AI adoption. AI can replicate labor activities at much greater scale and speed, and even perform some tasks beyond the capabilities of humans, says a 2017 Accenture report. For example, having humans scout for defects in steel production has proved unworkable but ArcelorMittal, the world’s largest steelmaker, says it has proof that deep-learning neural networking technology — artificial intelligence software that learns on the fly — can do it with 93% accuracy. However, “more than data and technological savvy are required to capture value from automation,” says an earlier 2017 McKinsey report. “The greater challenges are the workforce and organizational changes that leaders will have to put in place as automation upends entire business processes, as well as the culture of organizations,” says the report. “Senior leaders, for their part, will need to ‘let go’ in ways that run counter to a century of organizational development.” Business sectors being disrupted by AI include:

- HEALTHCARE: AI-based services will play a growing role in automated diagnosis, support and advice in healthcare.

- AUTOS AND TRANSPORT: Self-driving cars will operate without human input. People will be able to control a car’s cockpit functions through voice commands. Airlines will use AI to improve customer service.

- FINANCIAL AND LEGAL SERVICES: Advances in robotics and AI will likely disrupt 25 million workers within these sectors globally, generating up to 55% in productivity gains.

- MANUFACTURING: AI and robotics will fundamentally change the way factories are run and supply chains operate.

- AGRICULTURE: Take-up is expected to include site-specific crop management. For example, computer vision and machine learning can be combined with robotic systems to apply plant-by-plant fertilizer wherever needed, identifying each sprout on a farm as lettuce or a weed and provide yield optimization.

- RETAIL: AI is poised to transform the way retailers interact with customers. Victoria’s Secret PINK is already using an AI-driven chat service to sell bras to teenage girls. And Cosabella, an Italian luxury lingerie maker, says it has doubled its subscribers and grown its email-led revenues by more than 60% compared to 2015, using an AI-enabled marketing automation tool.

- OIL, GAS AND MINING: Big data and the automation of trucks, trains and drills are set to transform the sectors.

It is no surprise then that in an Accenture poll, 85% of executives at big companies said they planned to invest heavily in AI over the next three years. Will it be money well spent? A lot depends on the quantity and quality of the data. Machine learning, a technology that has underpinned the recent major advances in artificial intelligence in computer vision, speech recognition and language translation, is a data-driven approach. Big companies will need robust sets of data to initially train the AI to interact with customers and employees, but also for the technology to continuously learn how those interactions should evolve, says a recent Accenture report.

Making the Most of Data

In 2011, McKinsey Global Institute released a report calculating the potential revenue and efficiency gains Big Data could generate across sectors. Five years later, in December of 2016, it released an update.

The results were not good: the retail sector captured only 30% to 40% of the value McKinsey Global Institute had estimated; manufacturing captured just 20% to 30%; and the public and healthcare sectors a mere 10% to 20%. This is a significant shortfall given the amount companies have invested in Big Data over that same five-year period. According to NewVantage Partners, 95% of executives at major corporations surveyed last year reported that their organizations had launched Big Data initiatives, 37.2% said more than $100 million had been invested in those initiatives, and 6.5% said the investment exceeded $1 billion. The persistent gap between corporate investment and value derived is due to three core challenges, says 13D Research, an independant global research investment firm.

Most companies have failed to break down old-model-departmental silos, meaning insights derived from Big Data are not being synchronized across operations. Secondly, organizations have not fully digitized transactions and processes, meaning the data available for analysis often represents only small portion of a company’s operations. And, says 13DResearch, the technological tools empowering data collection have progressed faster than the ability of software and humans to collaboratively analyze that data. While AI promises to be able to pinpoint high-value statistical relationships, the research firm notes it cannot solve the institutional issues inherent to the first two problems. As AI ramps up the number of actionable insights derived from Big Data, organizations lacking synergy will no doubt be overwhelmed, only decreasing the ratio between potential revenue and efficiency gains and actual value derived, says 13DResearch. Meanwhile, the incomplete data sets possessed by companies will mislead the AI, therefore generating flawed correlations at a time when competitive pressure will demand far-greater faith in big data-derived insights. Big companies will need robust sets of data to initially train the AI to interact with customers and employees, but also for the technology to continuously learn how those interactions should evolve, says a recent Accenture report.

Don’t Overestimate the Results

“As Neil Lawrence (a computer scientist at the UK’s University of Sheffield), points out, during the industrial revolution coal was the fuel so all the factories and the people moved to where the coal was,” says Jeffrey Ng, chief scientist at Founders Factory, a London-based accelerator that works with corporations grappling with technology transformation. “Today the fuel is the data and the engine is the algorithms that come out of that. That is the model powering all of the AI at the moment. Big companies have to realize that they have the fuel — the data — but they have to make good use of it.” That is easier said than done, says Jeanne W. Ross, a principal research scientist at the MIT Sloan School of Management Center for Information Systems Research. She notes that Google has successfully used AI to manage energy consumption at its data processing centers, resulting in an annual net savings of 15%, no small sum considering its centers use a measurable percentage of the world’s energy. But, she says, Google had to propose the initial parameter so that the machine could obtain the data. It took “very smart people, two years and a ton of money,” says Ross. Other companies will not necessarily meet with the same success. “It is very easy for companies to underestimate the cost and overestimate the results,” she says.

Her advice to executives who want to apply AI to their businesses? “Start with little things you can understand that will result in incremental improvements,” she says. “If you go for the big bang the odds of it paying off are not very good.”