By 2020, companies will be spending about €250 billion a year on the Internet of Things (IoT), a network of connected objects able to collect and exchange data using embedded sensors, according to the Boston Consulting Group.

About half of that spending will come from the manufacturing, transport and utility industries. Business uses for the IoT include predictive maintenance, data monitoring, optimizing the production process, automated inventory management, and the tracking and tracing of products or animals.

Last year there were 2.4 billion connected devices being used by businesses, and this year there will be 3.1 billion, according to research firm Gartner. By 2020, it expects that number to have more than doubled to 7.6 billion.

But the implementation of automated monitoring and control systems is being held back by connectivity issues.

That’s where Actility, a global startup founded in France, comes in.

Actility’s low-power, wide-area networking technology allows long-range communications among connected devices while promising to optimize both costs and power-consumption requirements.

Actility’s ThingPark wireless technology works in the 5–15 km range and offers 10 years of battery life. In addition to connectivity Actility says it can help companies make sense of device and sensor data.

Actility started by supplying its technology to telecom carriers but is now expanding its offer to include smart factories and buildings and businesses in the logistics and supply chain, agriculture and energy and utilities sectors .

In the case of smart cities, Actility’s low-power wide-area networking platform enables new IoT services like smart parking, waste management, street lighting or air quality control. Building on a dedicated long range low-power network for IoT, city authorities can connect battery-powered objects into a single network, enabling data collection from parking sensors, air quality monitoring equipment, flood detection sensors or smart meters, says Actility. The data is then fed to centralized intelligent systems which can make recommendations to optimize city service management.

In the agricultural sector automated monitoring and control systems is especially limited by the poor coverage of cellular networks in sparsely populated rural areas. Actility says its technology can provide farmers with 24/7 visibility on soil and crop health, machinery in use, storage conditions, animal behavior and energy consumption. Farmers can review all collected data on a single dashboard, allowing them to get a complete overview of what is happening on their land and to gather information to plant crops, limit fertilizer usage and maximize yield.

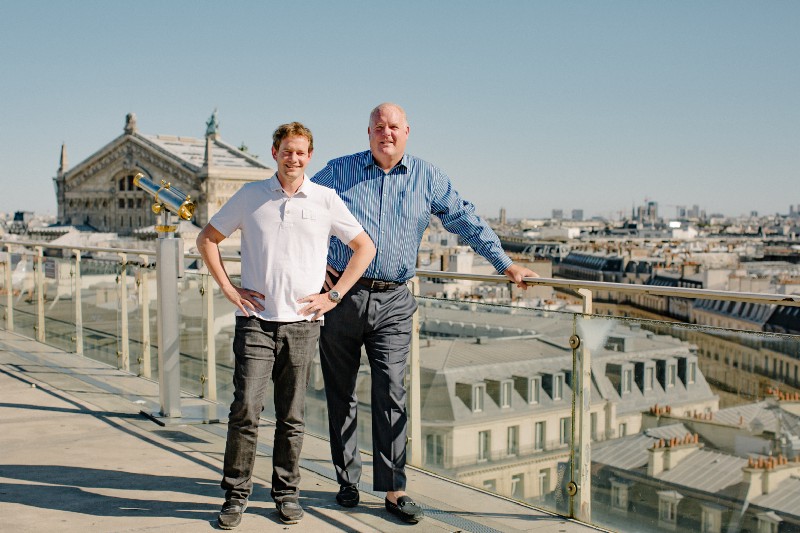

Actility founder and CTO Olivier Hersent and CEO Mike Mulica

Actility founder and CTO Olivier Hersent and CEO Mike MulicaLogistics is another area being targeted by Actility. Increasingly complex supply chain routes increase the need for real-time localization and dynamic tracking of goods on land, sea and air, and during storage in warehouses.

Current tracking technologies such as radio frequency identification (RFID) will locate products only at specific locations. And GPS location combined with cellular connectivity cannot offer sufficient battery lifetime for end-to-end route tracking.

Actility says its low power wide area technologies offers enhanced battery life for trackers, enabling the end-to-end dynamic tracking of goods between manufacturing plants, warehouses and end customers.

Taking advantage of public nationwide or privately operated low-power wide-area networking industrial users can deploy tracking devices with both GPS and low-power wide-area networking connectivity, dramatically increasing the battery life to several months instead of days, the company says.

Actility’s technology also works inside warehouse and storage facilities, adding even more battery life, the company says. Integrating data from other sensors offers further advantages. By introducing traffic monitoring sensors, for example, supply chain operators could adapt to traffic conditions, avoid delays and save fuel; and data from weather, temperature or humidity sensors, will help ensure that the cold chain is respected.

Actility, the co-founder of a fast growing non-profit industry association called the LoRa Alliance, says it currently owns more than half of all national and large scale low networks

.Only 20% of the global population is now covered by low-power, wide-area networks that allow long-range communications among connected devices while optimizing both costs and power-consumption requirements, according to a May report on The Internet of Things from global management consultancy McKinsey & Company. It is predicting that will rise to 100% coverage by 2022.

Strong demand for low-power wide-area networks helped Actility raise a $75 million Series D venture capital round in April. Investors in the round include Cisco, Bosch, FoxConn, Orange Digital Ventures, KPN, Swisscom, Bpifrance, IDinvest and Ginko Ventures.